Table of Contents

Introduction

Welcome to a comprehensive guide on How to Save Money: 10 Proven Ways. In today’s fast-paced world, managing finances wisely is crucial. Whether you’re aiming for a big purchase, building an emergency fund, or just looking to make smarter choices, we’ve got you covered. Let’s delve into practical and effective strategies that will set you on the path to financial success.

Proven Strategies for Saving Money

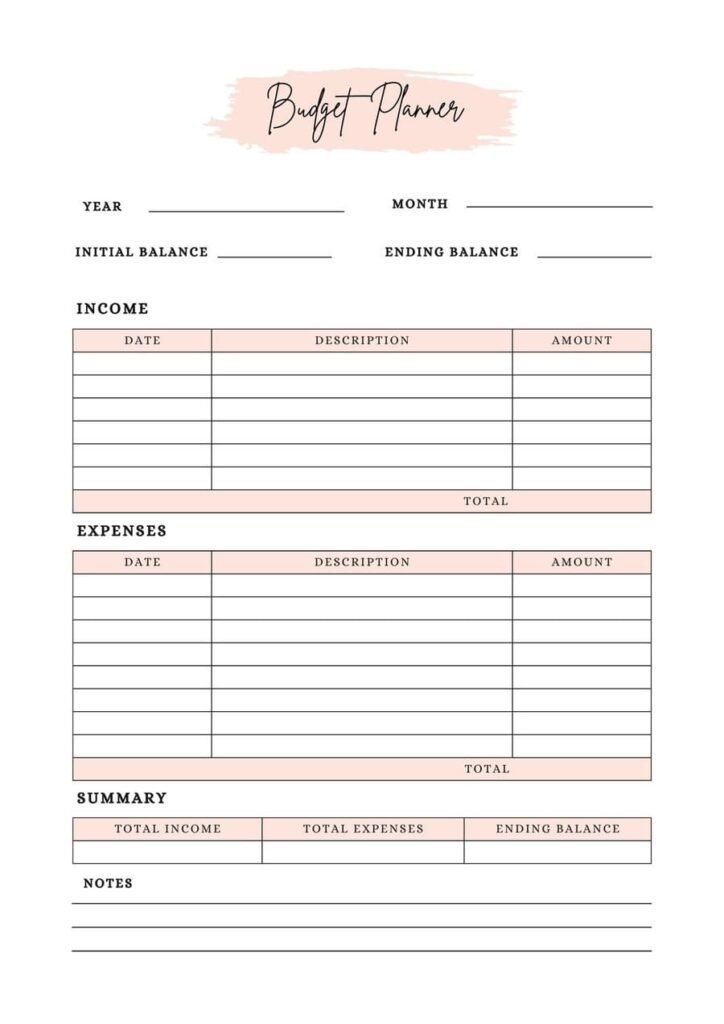

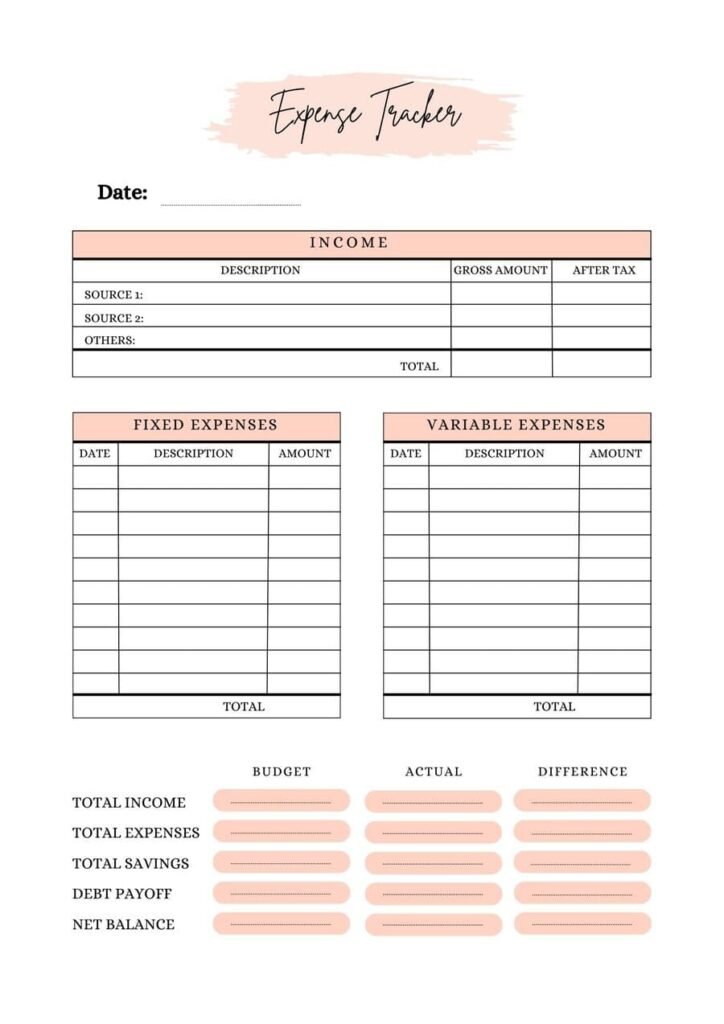

1. Smart Budgeting

Embarking on a journey to save money starts with a solid budget. Break down your expenses, identify non-essential costs, and allocate specific amounts for different categories. This disciplined approach ensures you’re aware of your financial landscape and can make informed decisions.

2. Cutting Unnecessary Expenses

Trimming the excess is an art when it comes to saving money. Identify subscriptions, impulse purchases, or unused services that can be eliminated. Small changes can add up, contributing significantly to your savings over time.

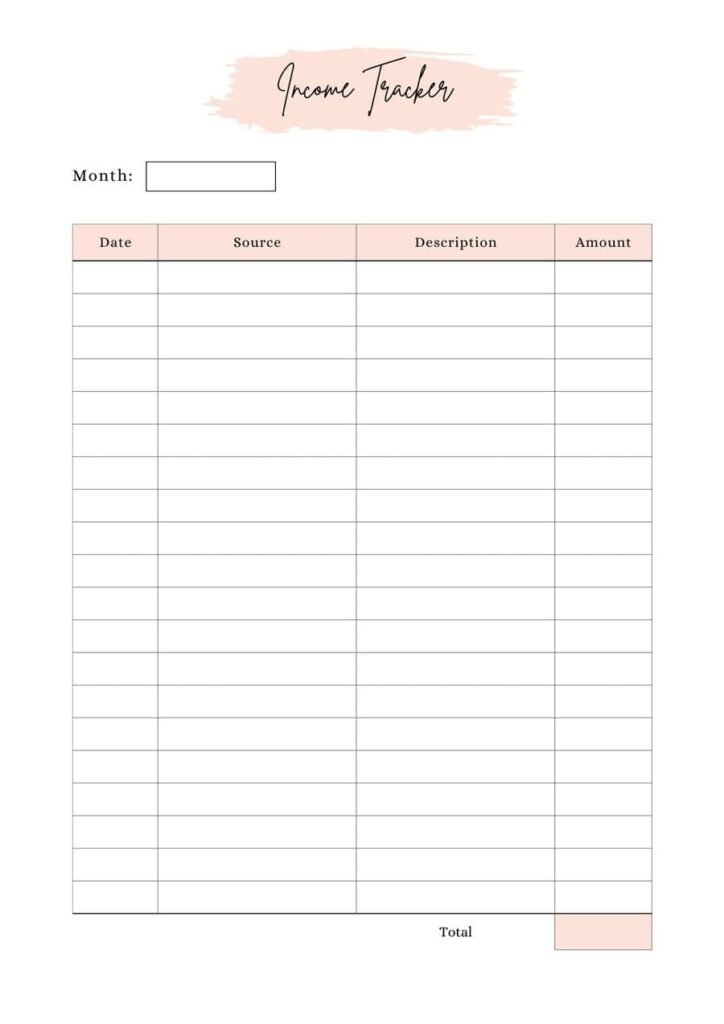

3. Earning Extra Income

Sometimes, the key to saving more is earning more. Explore side hustles or freelance opportunities that align with your skills and interests. This additional income can serve as a valuable boost to your savings.

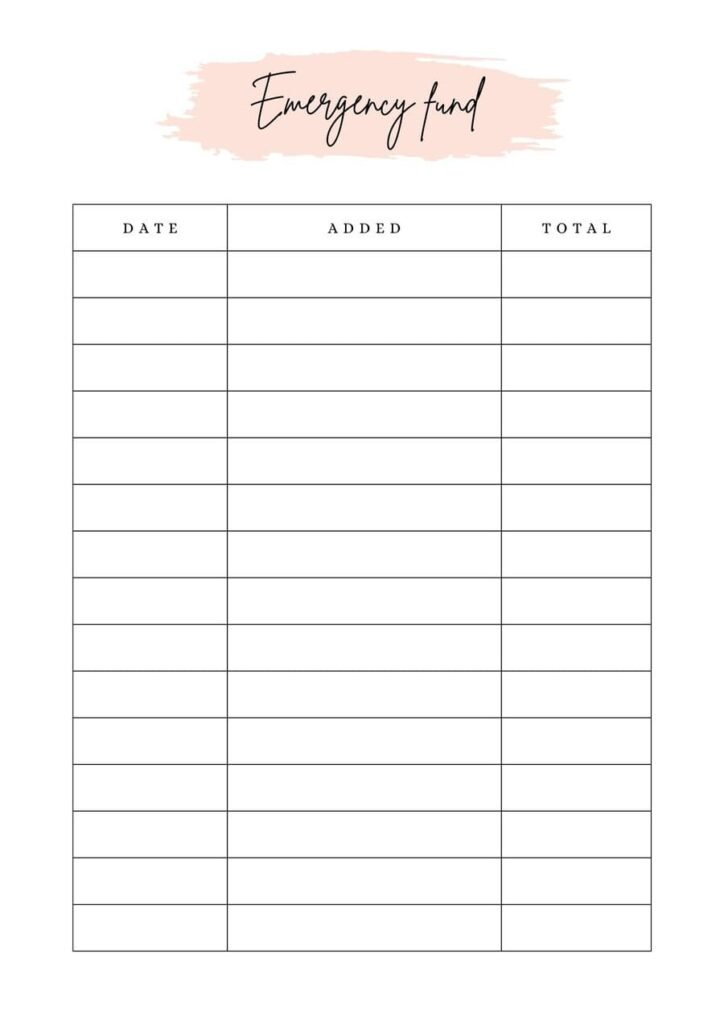

4. Creating an Emergency Fund

Financial emergencies can arise unexpectedly. Establishing an emergency fund acts as a safety net, preventing you from dipping into your savings for unforeseen circumstances. Aim for at least three to six months’ worth of living expenses.

5. Automating Savings

Make saving a seamless part of your routine by setting up automatic transfers to your savings account. This hands-off approach ensures consistent contributions without the need for constant monitoring.

6. Investing Wisely

Consider exploring investment options to make your money work for you. While the stock market can be intimidating, there are beginner-friendly investment platforms that offer accessible ways to grow your wealth over time.

7. Shopping Smartly

Become a savvy shopper by hunting for deals, using coupons, and comparing prices. Embrace the mindset of getting value for your money, and watch your savings grow with each intelligent purchase.

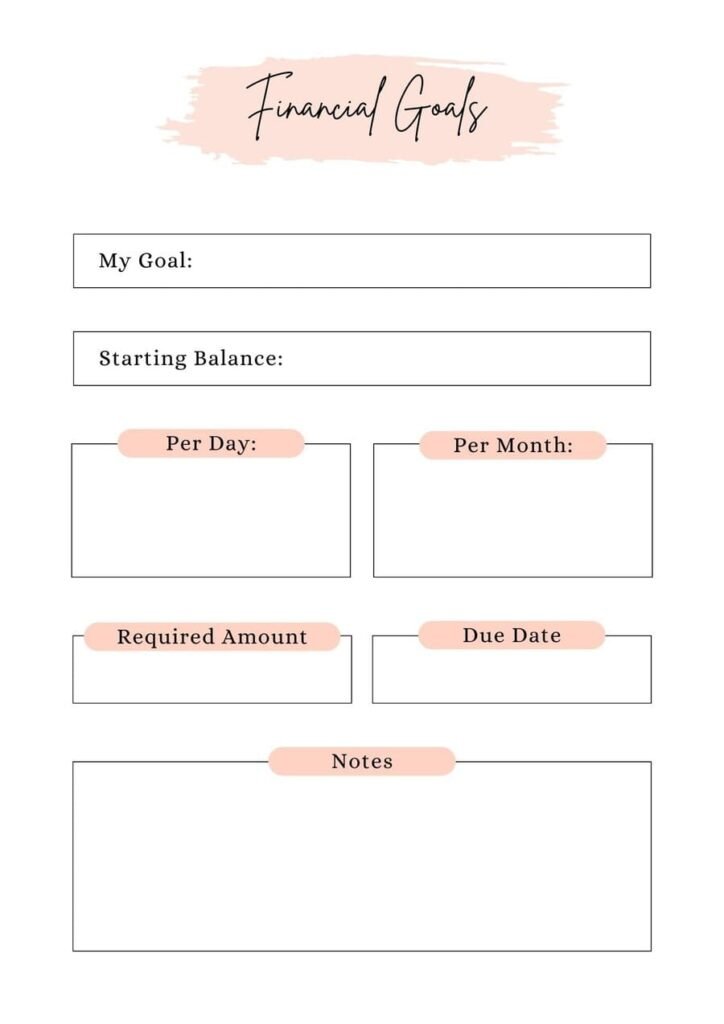

8. Set Goals

Setting clear financial goals provides direction and motivation. Whether it’s saving for a vacation, a down payment, or retirement, having specific objectives helps you stay focused and disciplined in your saving efforts.

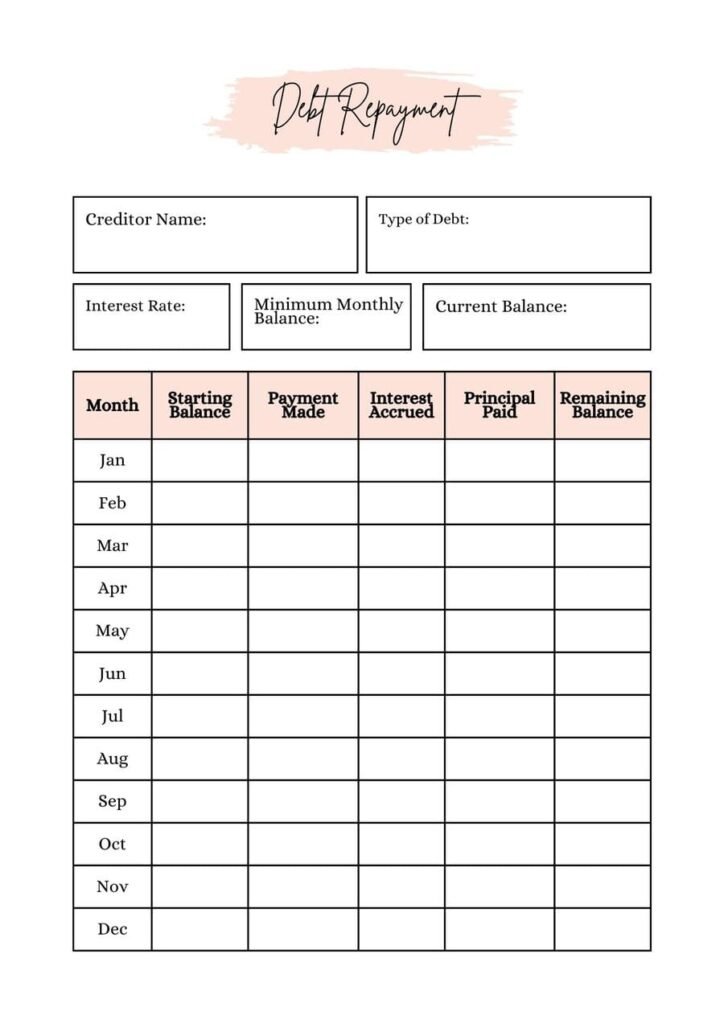

9. Debt Repayment Strategies

High-interest debts can be a significant drain on your finances. Implement effective debt repayment strategies, focusing on clearing high-interest debts first. This will free up more funds for savings in the long run.

10. Cultivating a Frugal Lifestyle

Embrace a frugal lifestyle by finding joy in simple pleasures. From cooking at home to exploring free entertainment options, small adjustments can lead to significant savings without sacrificing happiness.

Frequently Asked Questions

What is the 50 30 20 rule?

The 50/30/20 rule is a popular budgeting guideline that suggests dividing your after-tax income into three categories:

50% for needs: Essential expenses like rent, utilities, groceries, and insurance.

30% for wants: Non-essential expenses like dining out, entertainment, and leisure activities.

20% for savings: Allocating a portion of your income to savings and debt repayment.

How to save $10,000 in 3 months?

Saving $10,000 in three months requires disciplined financial planning and potentially making significant adjustments to your spending. Some strategies include:

– Create a detailed budget to track and minimize expenses.

– Identify non-essential spending and cut back.

– Consider additional income sources, like a part-time job or freelance work.

– Direct a significant portion of your income towards savings each month.

How to save $1,000 in 30 days?

Saving $1,000 in 30 days involves setting a clear goal and making intentional financial decisions:

– Cut unnecessary expenses such as dining out, entertainment, or subscription services.

– Create a specific budget for the month and stick to it.

– Look for additional income opportunities, like selling unused items or taking on a short-term gig.

– Consider temporarily reducing contributions to non-urgent savings goals.

What is the 30 20 10 rule for saving?

The 30/20/10 rule is a savings guideline that suggests allocating a percentage of your income as follows:

30% for short-term savings: Emergency fund, upcoming expenses.

20% for long-term savings: Retirement accounts, investments.

10% for personal savings: Personal goals, like a vacation or major purchase.

Conclusion

In conclusion, mastering the art of saving money involves a combination of strategic planning, disciplined budgeting, and smart financial choices. By implementing the proven ways discussed in this guide, you’re well on your way to achieving your financial goals. Start your journey today and witness the positive impact on your financial well-being.